Tax Rate Average American . the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. You pay tax as a percentage of. The share of agi reported by the. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. see current federal tax brackets and rates based on your income and filing status. the average income tax rate in 2021 was 14.9 percent. personal income tax rates. The share of agi reported by the top 1. Millions of americans actually get.

from taxfoundation.org

personal income tax rates. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher. The share of agi reported by the top 1. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. The share of agi reported by the. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. Millions of americans actually get. You pay tax as a percentage of. see current federal tax brackets and rates based on your income and filing status.

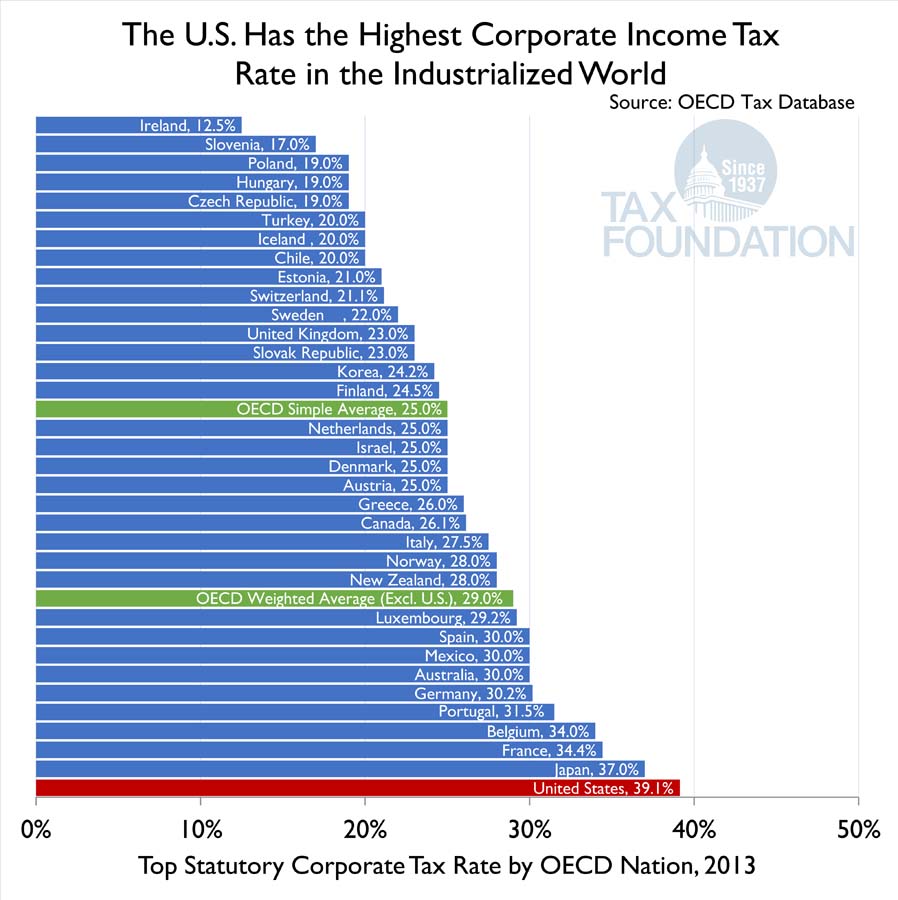

The U.S. Has the Highest Corporate Tax Rate in the OECD Tax

Tax Rate Average American the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. The share of agi reported by the top 1. see current federal tax brackets and rates based on your income and filing status. You pay tax as a percentage of. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. Millions of americans actually get. The share of agi reported by the. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. personal income tax rates. the average income tax rate in 2021 was 14.9 percent.

From taxfoundation.org

The Top 1 Percent’s Tax Rates Over Time Tax Foundation Tax Rate Average American Millions of americans actually get. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. the average income tax rate in 2021 was 14.9 percent. personal income tax rates. The share of agi reported by the. You pay tax as a percentage of. The share of agi reported by the. Tax Rate Average American.

From aseyeseesit.blogspot.com

DataDriven Viewpoints A 99 YEAR HISTORY OF TAX RATES IN AMERICA Tax Rate Average American the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. The share of agi reported by the. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. The share of agi reported by the top 1. the average individual income tax rate for all. Tax Rate Average American.

From taxfoundation.org

State Tax Rates and Brackets, 2021 Tax Foundation Tax Rate Average American Millions of americans actually get. You pay tax as a percentage of. The share of agi reported by the. personal income tax rates. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. The. Tax Rate Average American.

From printableformsfree.com

2023 Federal Marginal Tax Rates Printable Forms Free Online Tax Rate Average American The share of agi reported by the. Millions of americans actually get. see current federal tax brackets and rates based on your income and filing status. The share of agi reported by the top 1. You pay tax as a percentage of. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent.. Tax Rate Average American.

From taxfoundation.org

How Much Do People Pay in Taxes? Tax Foundation Tax Rate Average American The share of agi reported by the. the average income tax rate in 2021 was 14.9 percent. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher. the average individual income tax rate for. Tax Rate Average American.

From www.foxnews.com

Where your tax dollars go after you pay the IRS Fox News Tax Rate Average American Millions of americans actually get. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. The share of agi reported by the. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. the average income tax rate in 2021 was 14.9 percent. the average. Tax Rate Average American.

From taxfoundation.org

The U.S. Has the Highest Corporate Tax Rate in the OECD Tax Tax Rate Average American see current federal tax brackets and rates based on your income and filing status. the average income tax rate in 2021 was 14.9 percent. personal income tax rates. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. the average individual income tax rate for all taxpayers fell from. Tax Rate Average American.

From exonbhkvh.blob.core.windows.net

What Are The Tax Brackets For Louisiana at Jennifer Bogle blog Tax Rate Average American the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. You pay tax as a percentage of. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher. see. Tax Rate Average American.

From taxfoundation.org

Taxes on the Rich Were Not Much Higher in the 1950s Tax Foundation Tax Rate Average American You pay tax as a percentage of. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher. personal income tax rates. Millions of americans actually get. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. the average effective tax rate for those taxpayers was. Tax Rate Average American.

From ucaststudios.com

How Much Does It Take To Be The Top 1 In Each U.S. State? Tax Rate Average American the average income tax rate in 2021 was 14.9 percent. The share of agi reported by the. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. You pay tax as a percentage of. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher. Millions. Tax Rate Average American.

From www.richardcyoung.com

How High are Tax Rates in Your State? Tax Rate Average American the average income tax rate in 2021 was 14.9 percent. The share of agi reported by the top 1. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. personal income tax rates. The share of agi reported by the. You pay tax as a percentage of. the average individual. Tax Rate Average American.

From www.reddit.com

Average salary (before taxes) by US state according to PayScale r/MapPorn Tax Rate Average American The share of agi reported by the. The share of agi reported by the top 1. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. see current federal tax brackets and rates based on your income and filing status. The top 1 percent of taxpayers paid a 25.9 percent average. Tax Rate Average American.

From www.vividmaps.com

Average Tax Refund in Every U.S. State Vivid Maps Tax Rate Average American the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. personal income tax rates. The share of agi reported by the top 1. see current federal tax brackets and rates based on your income and filing status. the average effective tax rate for those taxpayers was 1.5%, even before refundable. Tax Rate Average American.

From www.morningbrew.com

U.S. Tax Burdens are Among the Developed World's Lowest Tax Rate Average American The share of agi reported by the top 1. You pay tax as a percentage of. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. the average individual income tax rate for all taxpayers. Tax Rate Average American.

From www.motherjones.com

Chart of the Day Tax Rates on the Rich and the Rest of Us Mother Jones Tax Rate Average American the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. the average effective tax rate for those taxpayers was 1.5%, even before refundable tax credits were applied. Millions of americans actually get. the average income tax rate in 2021 was 14.9 percent. personal income tax rates. The top 1 percent. Tax Rate Average American.

From www.chegg.com

Solved 5. Understanding marginal and average tax rates Tax Rate Average American The share of agi reported by the top 1. the average income tax rate in 2021 was 14.9 percent. personal income tax rates. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. the. Tax Rate Average American.

From dyernews.com

Which States Pay the Most Federal Taxes A Look At The Numbers Tax Rate Average American personal income tax rates. Millions of americans actually get. the average income tax rate in 2021 was 14.9 percent. The share of agi reported by the top 1. The share of agi reported by the. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher. the average individual income tax rate. Tax Rate Average American.

From www.statista.com

Chart Taxing The Rich How America's Marginal Tax Rate Evolved Statista Tax Rate Average American personal income tax rates. The share of agi reported by the top 1. Millions of americans actually get. the average individual income tax rate for all taxpayers fell from 14.6 percent to 13.3 percent. You pay tax as a percentage of. the average income tax rate in 2021 was 14.9 percent. the average effective tax rate. Tax Rate Average American.